Weatherford title loans offer swift financial aid for emergencies, using vehicle value as collateral. With minimal hassle, applicants get flexible payment plans after a simple application and inspection. Ideal for those with limited banking or credit options, these loans provide immediate funds while borrowers retain control of their vehicle.

In times of financial urgency, Weatherford title loans offer a reliable solution for quick cash access. This comprehensive guide delves into the world of Weatherford title loans, explaining how this secure lending option works and why it’s a viable choice for emergency funds. From understanding the process to exploring benefits and considerations, we break down the essentials of Weatherford title loans, empowering you to make informed decisions when facing unexpected financial challenges.

- Understanding Weatherford Title Loans: Unlocking Quick Cash Access

- How Do Weatherford Title Loans Work: A Step-by-Step Guide

- Benefits and Considerations: Navigating Weatherford Title Loan Options

Understanding Weatherford Title Loans: Unlocking Quick Cash Access

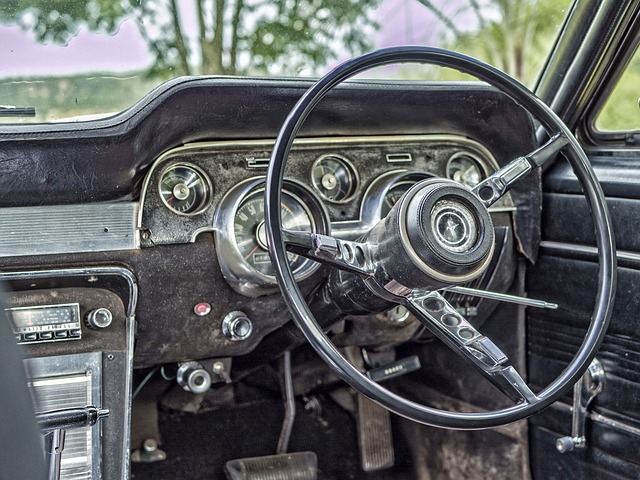

Weatherford Title Loans offer a unique solution for individuals seeking swift financial assistance during emergencies. This type of loan leverages the value of an individual’s vehicle, providing quick cash access with minimal hassle. The process begins with a simple application, where borrowers provide details about their vehicle and personal information. Following this, a representative conducts a brief vehicle inspection to assess its condition and determine its worth.

Once approved, Weatherford Title Loans provides borrowers with flexible payment plans tailored to their financial capabilities. Unlike traditional loans, these titles loans offer a more accessible path to emergency funds, especially for those who may not have excellent credit scores or limited banking options. This alternative financing method allows individuals to maintain control of their vehicle while securing the necessary cash flow to navigate through unforeseen circumstances.

How Do Weatherford Title Loans Work: A Step-by-Step Guide

Weatherford Title Loans offer a unique solution for those needing quick funding in an emergency. Here’s how it works step-by-step:

1. Application: First, you apply online or visit a Weatherford Title Loan location with your vehicle’s title. This process is straightforward and takes only a few minutes. You provide basic information and details about your vehicle for verification.

2. Assessment: Next, the lender assesses your application, reviewing your financial history, income, and the value of your vehicle. They determine loan terms suitable for your situation, focusing on manageable repayment plans that align with your budget.

3. Direct Deposit: Once approved, the lender securely deposits the agreed-upon loan amount directly into your bank account, providing quick funding when you need it most. This efficient process ensures you have access to emergency cash without unnecessary delays.

Benefits and Considerations: Navigating Weatherford Title Loan Options

Weatherford Title Loans offer a unique solution for individuals seeking swift financial aid during emergencies. One of the primary benefits is their accessibility; they provide an alternative to traditional bank loans, catering to those with limited credit history or poor credit scores. These loans are secured against vehicle ownership, allowing borrowers to use their cars as collateral. This ensures that approval processes can be faster and more flexible compared to other loan types.

When considering Weatherford Title Loans, it’s essential to understand the repayment options available. Borrowers typically have the flexibility to choose from various repayment schedules based on their financial comfort zones. However, it’s crucial to assess one’s ability to repay promptly to avoid potential penalties or fees associated with late payments. As secured loans, these title loans carry a higher level of responsibility, requiring individuals to maintain clear vehicle titles and adhere to agreed-upon terms to regain ownership upon loan repayment.

Weatherford title loans offer a unique solution for those needing emergency cash. By utilizing the equity in your vehicle, these loans provide a swift and convenient way to access funds during financial emergencies. Understanding the process and weighing the benefits against considerations can help individuals make informed decisions when facing unexpected expenses. This alternative financing option deserves serious consideration, especially as it can be a game-changer in times of need.